40+ How much can i borrow with 50000 deposit

We also proudly offer our Members a variety of other banking products and services such as checking and savings accounts share certificates and much more. A 12-month Marcus by Goldman Sachs CD can earn you as much as 14 percent APY.

How Much Savings Should I Have Accumulated By Age

Andy for another example where he takes an FD of 1 month at 3 interest pa.

. If you do plan to borrow first check with your own bank as cheap rates for such large borrowing are often for existing customers only. The SOFR rate is the Secured Overnight Financing Rate which you can see on the Federal Reserve Bank of New York website. 10 Alternative Loans With Fast Funding Times.

Available to sole applicants with a minimum salary of 50000 or joint applicants with combined salaries of 75000 or where one party has an individual salary of 50000. Lenders typically like to see a DTI ratio of 40 or less though some lenders might make exceptions to this. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

With low-interest California credit union credit cards from CU SoCal customers can enjoy rewards on every purchase no annual fees and credit limits of up to 50000. Borrow at the lowest interest rate. Be VERY sure you can repay it.

Wealthfront offers a similar product a Portfolio Line of Credit. You could buy a 50000 share of it and pay rent on the remaining 150000 to the local housing association. Offset mortgage vs savings.

Penalty for early. For deposits of 50000 or more early. Your 5 deposit can be boosted by as much as 40.

How much can I borrow calculator Personal loan calculator Premier loan calculator. Provided the deposit is under 50000 you can close the account early for a fee of 90 days interest. Minimum daily balance of 10000 required to earn dividends.

Right now you can earn up to 085 APY. If you have just 25000 in assets vs. We like the monthly option because it encourages savings.

25 deposit to open Deposit at least 25 a month. Say he decides to deposit RM5000 into a fixed deposit account for 1 month at a rate. Each month you are only required to pay interest on the outstanding balance.

You could get higher rates on minimum deposits of. On your crypto - Get a Metal Visa Card up to 5 Rewards back - Buysell 250 crypto at True Cost - Deposit crypto get an instant loan - Earn Diamonds for Missions you complete. Earn between 140 AERgross and 220 AERgross depending on the term you choose.

Lenders decide how much you can borrow based on whats known as serviceability. How much can I borrow. However the amount of interest you pay can be reduced by offsetting your savings with us.

Most online banks cant carry the weight of your everyday banking needs. Household bills rent or mortgage payments. Ways to use a.

Schwabs higher 100000 requirement you can access this product and borrow against up to. Borrow between 1000 - 50000. How much can I borrow calculator Personal loan calculator Premier loan calculator.

Wealthfront Portfolio Line of Credit. Rates and terms subject to change without notice. For parents aged less than 60 years the corresponding amount is Rs 25000.

If you buy health insurance for your parents who are over 60 years in age you can claim tax deduction of up to Rs 50000 for the corresponding policy premium you pay. - Earn up to 145 pa. Employees contribution taxability.

Buying or putting down a deposit on a property static caravan or land. Rate may adjust if you discontinue direct depositpayroll or payment transfer. 3 Aggregate maximum unsecured loan limits credit card and personal loans not to exceed 50000 4 Rate includes a 050 reduction for payroll direct deposit at least half of net payroll into a CU SoCal Checking Account with automatic payment to your loan.

For borrowers looking for smaller loans PenFed a federal credit union provides a wide range of personal loan options and customers can borrow as little as 600 or as much as 50000. Do bear in mind that depending on when the withdrawal is made you. Interest rate or.

Read our full CIT Savings Builder review. The house must also be bought from a builder recognized by the program. The monthly subscription limit is 250.

As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. Margin investors may lose more than the amount they deposited in their account. Certain lenders offer personal loans up to 50000 though its a huge commitment so think very carefully before getting such a large amount.

You can borrow more than 7500 over a period of up to 8 years. They dont offer enough variety in banking products. 1 to 40 years.

You can borrow 1000 to 50000 5 with Upstart. How much you can borrow. You wont mind earning a lower fixed interest rate on your deposit accounts.

Home improvement loans can be taken out over 1-10 years. The line of credit only accrues interest on the funds you actually borrow and that amount is all that is due when you sell the home or pass If you have a line of credit for 100000 but you only ever used 50000 of it and the house is worth 200000 the other 50000 of unused line of credit goes nowhere but it also does not have to be. However if you do not save 250 in any given month you can carry over any unused subscription to following months.

Use the RinggitPlus fixed deposit calculator to know how much you can earn on. Personal loans for other purposes can be taken out over 1-8 years. It does require a 100 minimum deposit to open.

To earn the top rate you need to either deposit 25000 which is scary for a college student or you can deposit 100 per month. Is authorized at its discretion and without prior notice to you to liquidate any or all securities or other assets held in the account a to. Page 5 of 26 AMTD 086 0522 3.

Principal interest Owner-occupier 40 min. Open an Account at CIT. And for 12-months at 340 interest pa.

Employees own contribution of up to Rs 50000 is eligible for deduction over and above the limit of Rs 150000 To take this a step further the existing withdrawal provisions of Exempt Exempt Taxable EET have been tweaked and 40 of the corpus is proposed to be tax-free at withdrawal. Membership subject to approval. 50000 annual gross income at 30 1250 per month.

Opening deposit 100 minimum to 500 maximum Monthly deposits between 10 minimum to 500 maximum Withdrawal of certificate funds before maturity may be subject to penalties.

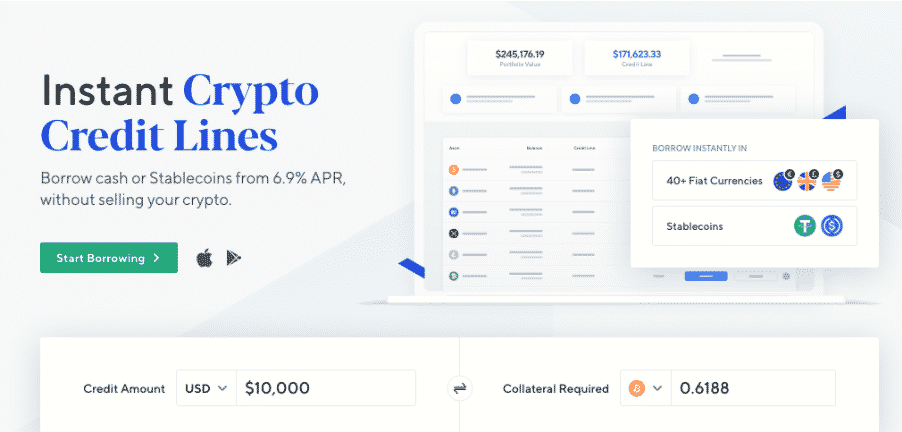

New 500 Minimum Amount For Nexo S Instant Crypto Credit Lines Nexo

Is It Possible To Claim Tax Benefits On Personal Loans Quora

How Much Savings Should I Have Accumulated By Age

Sample Code 2016 Company Data Full 1468846551 Json At Master Robert Boersig Sample Code 2016 Github

How Much Does One Make From Day Trading Quora

147 Days Ago I Proudly Posted My Account Balance Having Saved Just Over 2000 In 4 Months After Starting At 12 In My Account Working At 11 Hr In Chicago By Making A

2

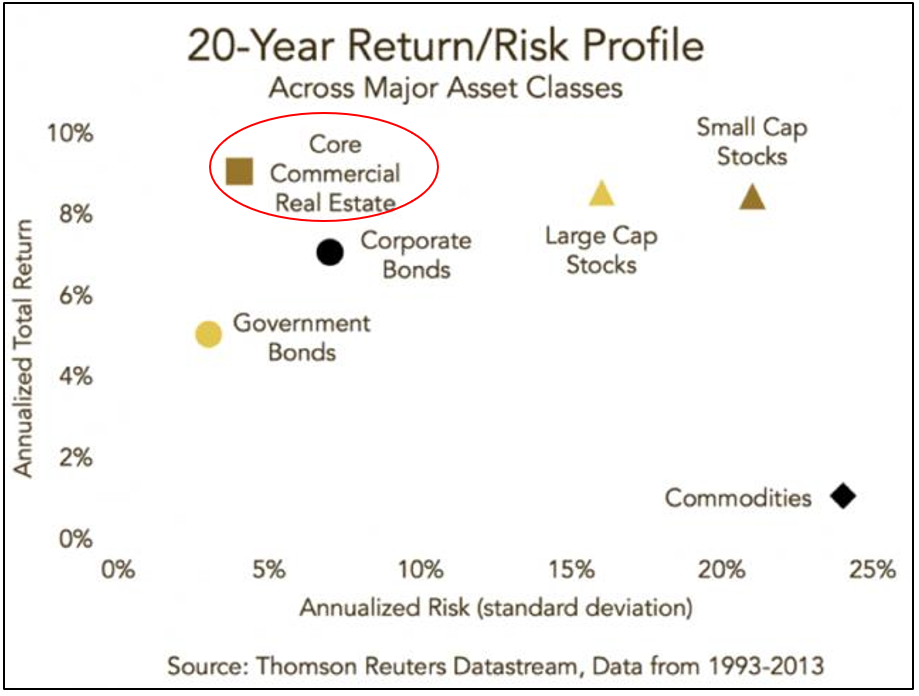

How I Earn High And Passive Income From Rental Properties Seeking Alpha

Kucoin Review Low Fees And Global Availability

Rbc Direct Investing Review 2022 Pros And Cons Uncovered

Maturity Value Formula Calculator Excel Template

Nuv9zjcu3vohcm

Best Crypto Exchange In Vietnam For September 2022

Coffee And Netflix R Whitepeopletwitter

Blockfi Vs Nexo Which Is The Best Crypto Interest Account Coincentral

How Much Is The Average I20 Amount For Ms In Cs How Much Fund Do We Need To Show In The Bank Account As Savings Or Property And How Much Amount We

7 Best Crypto Staking Platforms Sep 2022